As a Forex trader, you might have been asked by a friend or relative what exactly a research analyst does. Do they just sit around and research all day? What do they look for in Forex? Why does Forex research matter?

What exactly do Forex research analysts do? Well, Forex research is critical, and it can be your key to successful Forex trading. Forex research provides the necessary information that you need to make an informed Forex decision of whether or not you should enter a trade.

What Is A Research Analyst Anyway?

A research analyst independently researches the Forex market to produce reports on trading and trading opportunities.

Forex analysts also serve as an intermediary between traders and management, passing on information and trading ideas to interested clients so they may be able to make profitable Forex trades. They will also develop trading strategies based on current Forex market conditions.

The Forex analyst reports about major online Forex activity such as global economic events or new technological advancements, some of which will inevitably affect Forex prices. Forecast Forex prices can be difficult, as any number of unforeseen circumstances may affect Forex rates. Forex analysts often provide bullish and bearish forecasts and predict how Forex will behave in a particular situation.

What Kind Of Career Is Research Analysis?

For those interested in becoming a research or trading analyst, it is crucial to perform well at school to find work with Forex traders or associated companies.

Master’s degrees in business administration (MBA) are also beneficial because they typically include Forex research classes to prepare graduates for Forex trading positions.

You will also need to pass the Financial Industry Regulatory Authority (FINRA) Series 86 exam. Series 86 certification is required if you are applying for work as a research analyst.

What Do Forex Research Analysts Earn?

Forex trading salaries vary greatly based on your position, education level, experience, and the Forex company you work for. The average starting salary in Forex is around $35K (USD), but highly regarded research analysts can make as much as $100K.

Forex traders with a CFA (Chartered Financial Analyst) designation typically earn more than those without, as the test is considered difficult and demonstrates your understanding of Forex trading.

Forex traders tend to work longer hours than other professionals, so Forex salary levels are usually based on the long-term assumption that you will be putting in more time. Forex trading can also lead to bonuses for high-performing analysts.

Forex analysts working for well-established Forex companies who pass the regulatory exam typically earn more than those working with smallerForex companies.

What Skills Must Forex Research Analysts Have?

Like Forex trading, Forex research is a business that requires special skills and expertise. Forecasters must be able to read the market and deliver their opinions with conviction.

Analysts need analytical ability, market insight, financial knowledge, and excellent presentation skills for meetings with Forex traders and Forex companies.

Forecasters also need to understand the Forex market as well as possible, including Forex technical analysis and Forex fundamental analysis to develop strategies to profit from trades. In addition, they must be able to work independently and in a team environment with Forex teams.

Types Of Careers For Financial Analysts

Financial analysts typically fall into one of three categories: fundamental, technical, or Forex. Analysts who use Forex fundamental analysis look at Forex news reports, central bank Forex statements, trade Forex data, and company Forex performance to forecast the Forex market.

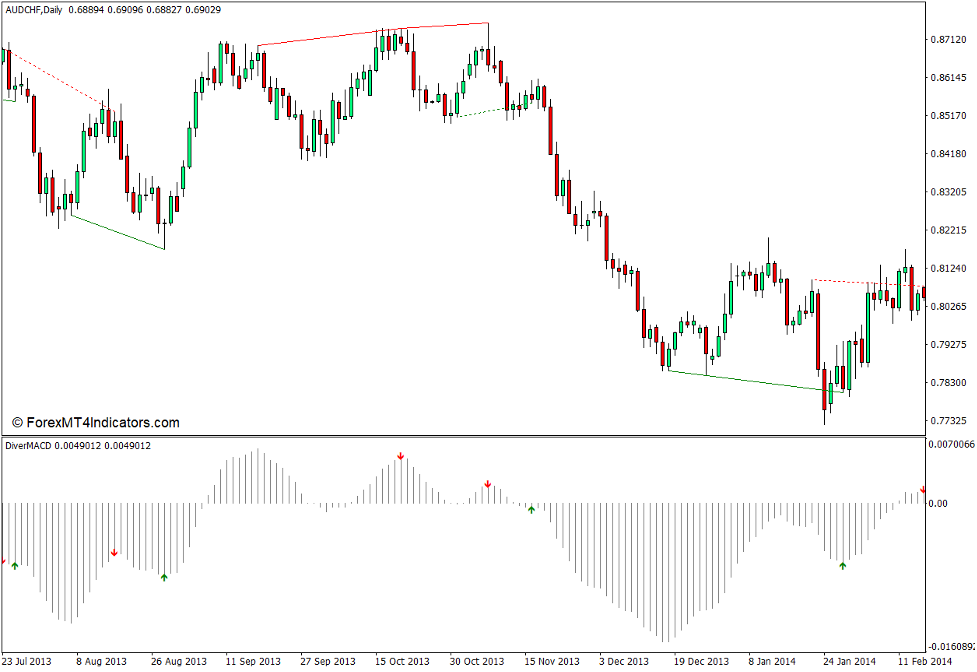

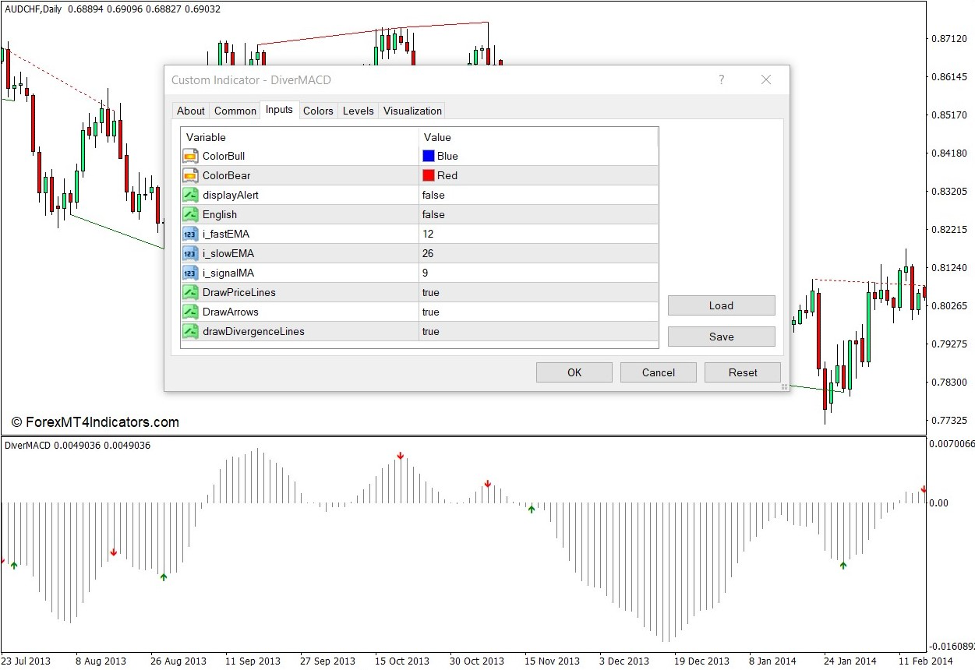

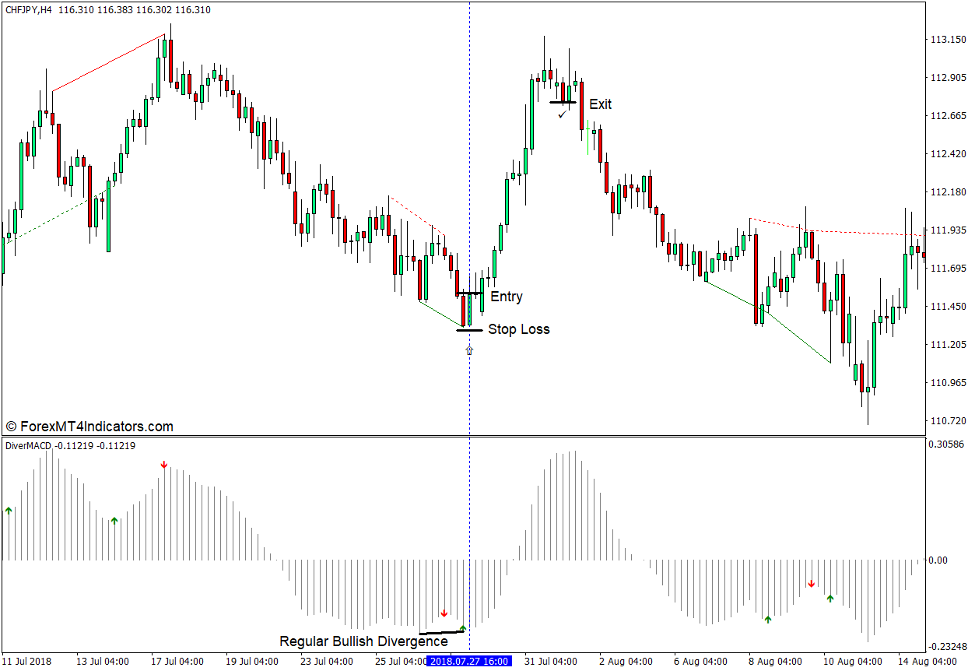

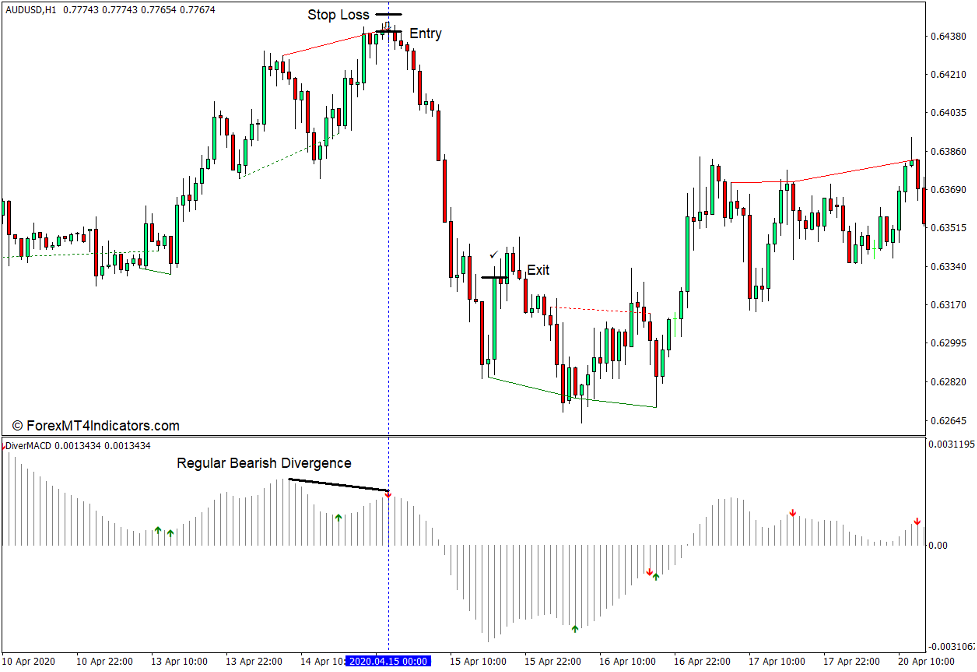

Technical analysts use charts to track Forex price movement to make Forex predictions. Finally, Forex analysts rely on their research in addition to Forex’s fundamental and technical data.

There are many Forex careers for research analysts. While some Forex research companies hire staff, others employ Forex traders on a short-term or long-term basis.

Forex traders may work in Forex brokerage firms or in Forex investment companies that provide Forex investment services to clients.

Forex analysts and traders may also work directly for Forex companies that deal in Forex research and Forex trading services.

As a research analyst, you can work as a sell-side analyst or buy-side analyst. Mutual funds or brokerage firms usually hire Buy-side analysts.

In contrast, the sell-side analyst is a different work path that involves providing an unbiased opinion based on proprietary research on a company’s securities.

A sell-side analyst’s objective is to persuade institutional investors to trade through the trading desk of the analyst’s firm, and it’s all about marketing. On the other hand, A buy-side analyst’s goal is to be correct rather than profitable.

The job of a buy-side analyst is about being right, and obtaining top-notch ideas is critical and preventing significant errors.

As a forex analyst, you can gain positions such as Retail Forex broker, Institutional Forex broker, Investment bank analyst, Forex trading research analyst, Forex Forecasting, and Forex Fund manager.

Forex Forecasting involves predicting Forex price movements for the Forex market, while Forex Fund manager manages a Forex fund.

Forex trading has many profitable careers, and Forex research analyst is one of them. Forex analysts conduct research and make Forex predictions based on Forex data and Forex fundamentals analysis to make profits through Forex trading. Analysts must be able to work independently as well as in a team environment with Forex teams.

La entrada Should You Become A Research Analyst? The Overview Of Career Paths se publicó primero en ForexMT4Indicators.com.

Should You Become A Research Analyst? The Overview Of Career Paths published first on https://alphaex-capital.blogspot.com/