Simple is good when it works! Many new traders first start discovering simple strategies. They learn something, see how it works and are amazed by it. They would start to believe it is the Holy Grail of trading. Many would experience inconsistent successes and failures. A streak of wins and losses every now and then. Then, they look for ways to improve their strategies. The same thing happens. They get pumped up only to find its inconsistencies. So, they repeat the process of discovering and learning.

Just as toddlers are like sponges learning every new word they hear, new traders are also very adept to learning something new. Although this should be a good thing, however, there are many cases wherein this could go out of hand. They would learn something new and incorporate it in their trading until their trading charts become a mess. Before they know it, they have a chart with 10 different indicators and 20 different rules. They have just simply overcomplicated their trading process. Still, many find themselves trading with inconsistent profits and losses.

There is no need to overcomplicate trading. Sometimes all we need are just a few technical indicators that work well when used together. Finding confluences that work synergistically could significantly improve the probabilities of your trade setup. QQE Super Trend is a trading strategy that works well because it is based on two high probability technical indicators. Individually, these indicators already produce great results. Combining these two complementary indicators further improves the strategy allowing traders to profit from the forex markets.

Qualitative Quantitative Estimation

Qualitative Quantitative Estimation, more popularly known as QQE, is a trend-following technical indicator. It is used primarily to help traders identify trend reversals both on the mid- and long-term, as well as the short-term momentum.

The QQE is displayed as an oscillating indicator. The usual versions of the QQE would display two lines oscillating around the midline which is at zero. One line would be solid, and another would be a dashed line. The solid line represents the QQE line, while the dashed line represents its signal line.

There are several ways to use the QQE indicator. First, traders could identify the bigger picture trend bias by looking at whether the QQE lines are positive or negative. This could either be a trade direction filter or a trade signal. Another approach would be to trade based on the crossing over of the two lines. This approach works as a momentum or short-term trend reversal signal. Lastly, mean reversal traders trade based on crossovers wherein the two lines are reversing back to the midline. Some would exit as the lines cross zero, while others ride the reversal until the two lines crossover indicating another reversal.

The QQE indicator is one of the few indicators that work well as a standalone indicator. Some traders even consider it as their “Holy Grail”. Still, it is best to use the QQE as part of a bigger picture trading strategy.

Super Trend Indicator

The Super Trend indicator is a trend-following technical indicator derived from the Average True Range (ATR).

Many traders use the ATR to identify trends and trend reversals. The most widely accepted idea behind the ATR and trend is that if price reverses by more than three times the current ATR, then the trend is reversing.

The Super Trend indicator is based around this concept. It detects the current trend direction. It then plots a line opposite the current trend direction. The line is plotted with a distance three times the current ATR. If price breaches the line, the line shifts indicating that the trend has reversed.

The Super Trend indicator could be used as a trend reversal signal, a trend direction trade filter, or as a stop loss placement. As a trend reversal signal, traders could take a trade based on the shifting of the Super Trend line. As a trend direction filter, traders could use it as a basis to filter out low probability trade setups based on the direction of the trend. As a stop loss placement, traders could trail their stop loss a behind the Super Trend line until stopped out.

Trading Strategy

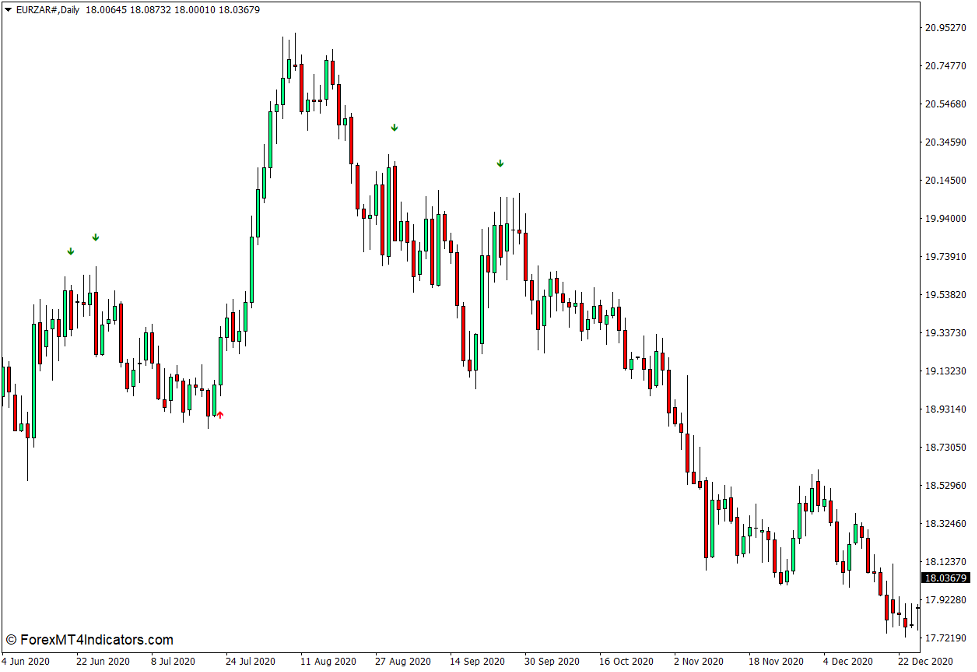

This trading strategy is a simple trading strategy that uses two high probability trend-following technical indicators, namely the QQE and the Super Trend indicators.

First, we would have to filter trades based on the bigger picture trend. To do this, we would be using the 100-period Exponential Moving Average (EMA). Trend direction will be mainly based on the slope of the 100 EMA line. Price could retrace and touch the 100 EMA line but should show signs of rejection on the area of the line.

Then, we filter the trend based on the Super Trend indicator. This will be based on the color of the line as well as the location of the line. The trend indication of the Super Trend indicator should align with the 100 EMA line.

Lastly, on the QQE indicator, we would be disregarding the dashed line. For this reason, we have preset the indicator not to show the dashed line. Instead, we will be using the crossing of the solid blue line over zero as a trend reversal indication. This will be our main signal. However, confluences with the trend reversal of the Super Trend indicator would also be a good signal.

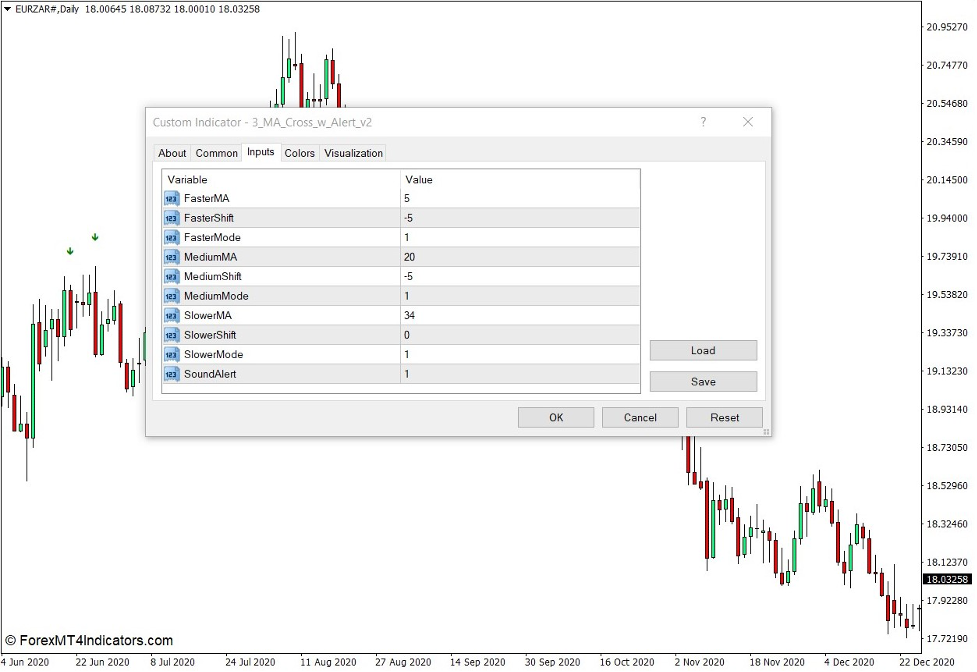

Indicators:

- 100 EMA (Green line)

- SuperTrend (default setting)

- QQE (default setting)

Preferred Time Frames: 30-minute, 1-hour and 4-hour charts

Currency Pairs: major and minor pairs

Trading Sessions: Tokyo, London and New York sessions

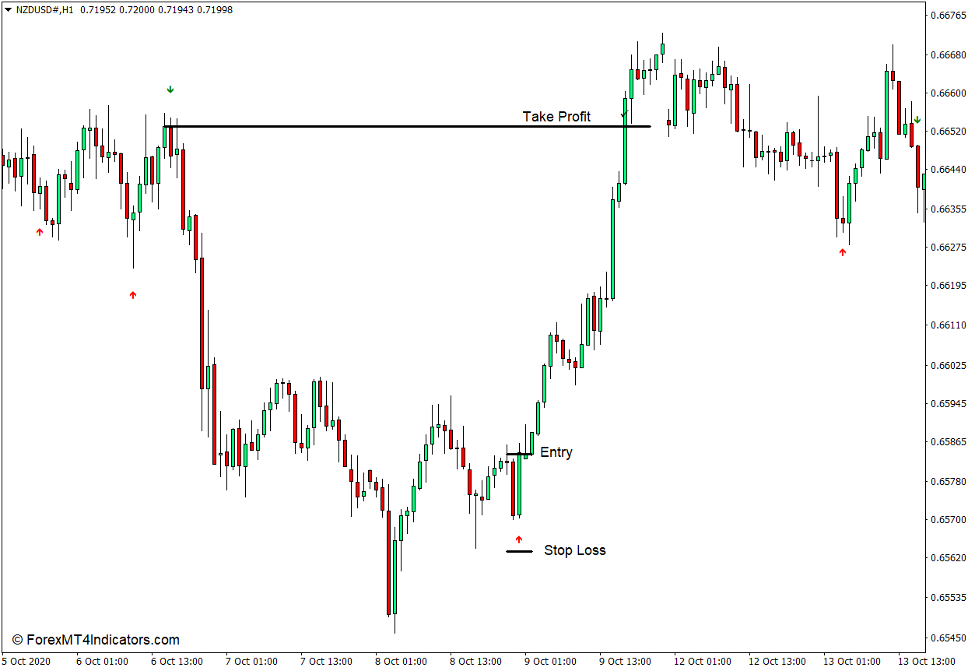

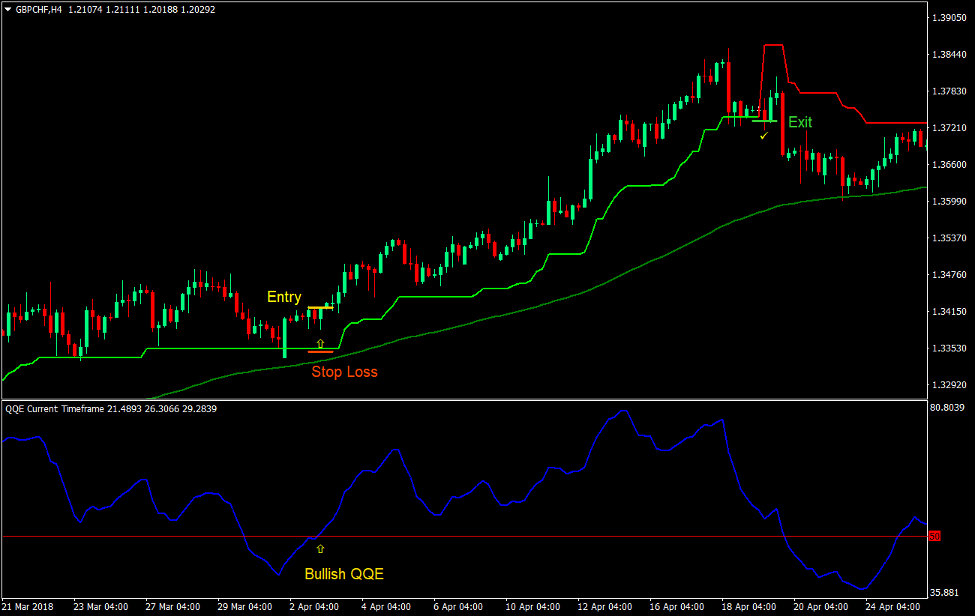

Buy Trade Setup

Entry

- The 100 EMA line should be sloping up.

- Price should be above the 100 EMA line.

- The Super Trend indicator should plot a lime line below price.

- The solid blue line of the QQE indicator should cross above zero.

- Enter a buy order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss below the Super Trend line.

Exit

- Close the trade as soon as the Super Trend line shifts above price and changes to red.

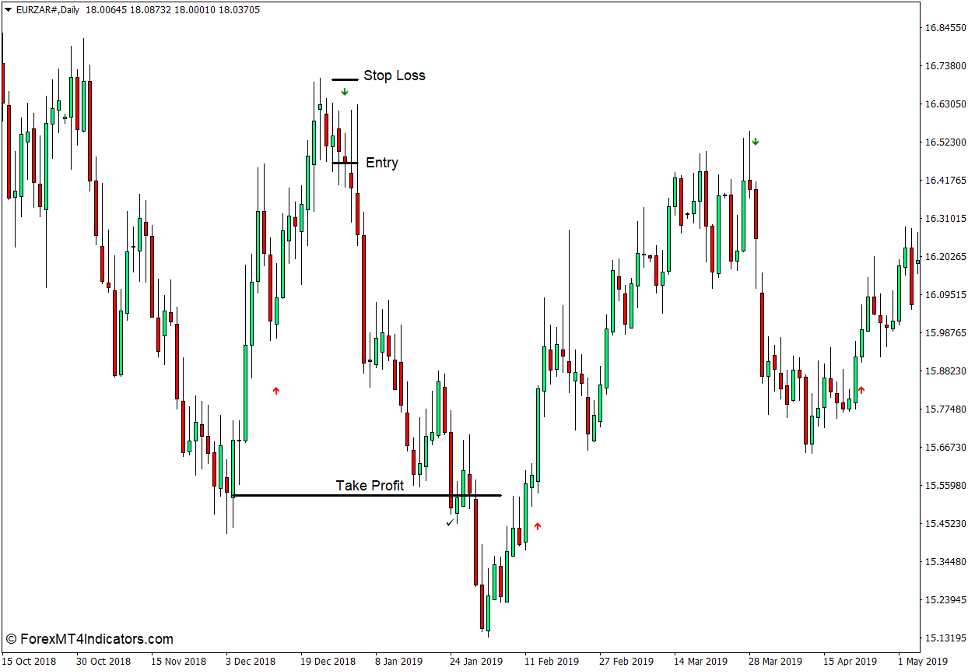

Sell Trade Setup

Entry

- The 100 EMA line should be sloping down.

- Price should be below the 100 EMA line.

- The Super Trend indicator should plot a red line above price.

- The solid blue line of the QQE indicator should cross below zero.

- Enter a sell order on the confirmation of the conditions above.

Stop Loss

- Set the stop loss above the Super Trend line.

Exit

- Close the trade as soon as the Super Trend line shifts below price and changes to lime.

Conclusion

This trading strategy could work well if used in a market that is trending. Signals are typically generated whenever price retraces towards the 100 EMA line.

It is also best to use this strategy in conjunction with price action. Candles that are showing signs of price rejection on the area of the 100 EMA line are good signals indicating that price is about to resume its trend.

Forex Trading Strategies Installation Instructions

QQE Super Trend Forex Trading Strategy is a combination of Metatrader 4 (MT4) indicator(s) and template.

The essence of this forex strategy is to transform the accumulated history data and trading signals.

QQE Super Trend Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye.

Based on this information, traders can assume further price movement and adjust this strategy accordingly.

Recommended Forex Metatrader 4 Trading Platform

- Free $50 To Start Trading Instantly

- Deposit Bonus up to $5,000

- Unlimited Loyalty Program

- Awards Winning Trading Broker

Click Here for Step By Step XM Trading Account Opening Guide

How to install QQE Super Trend Forex Trading Strategy?

- Download QQE Super Trend Forex Trading Strategy.zip

- *Copy mq4 and ex4 files to your Metatrader Directory / experts / indicators /

- Copy tpl file (Template) to your Metatrader Directory / templates /

- Start or restart your Metatrader Client

- Select Chart and Timeframe where you want to test your forex strategy

- Right click on your trading chart and hover on “Template”

- Move right to select QQE Super Trend Forex Trading Strategy

- You will see QQE Super Trend Forex Trading Strategy is available on your Chart

*Note: Not all forex strategies come with mq4/ex4 files. Some templates are already integrated with the MT4 Indicators from the MetaTrader Platform.

Click here below to download:

Save

Save

La entrada QQE Super Trend Forex Trading Strategy se publicó primero en ForexMT4Indicators.com.

QQE Super Trend Forex Trading Strategy published first on https://alphaex-capital.blogspot.com/